A combination of poor financial oversight, non-adherence to fiscal policies and an overextension of its financial leverage has led Puerto Rico into a decade-long fiscal decline, which has resulted in its inability to meet the financial obligation to its crushing debt.

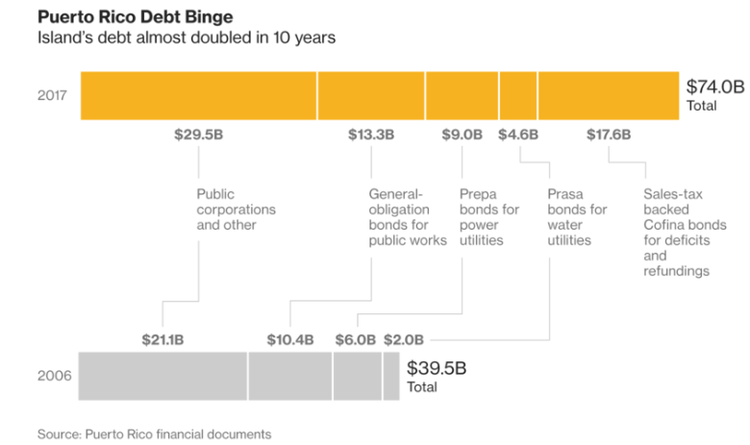

In May 2017, the Federal Financial Oversight Board pushed Puerto Rico into a restructuring process, known as Title III, which is quite like the restructuring processes that occurred in Detroit, MI, and Stockton, CA, amid their financial struggles. However, what sets this restructuring apart from Detroit or Stockton is its magnitude. Puerto Rico’s financial restructuring process for its $70 billion debt portfolio, and potential restructuring of its $40 billion pension liabilities, will be one of the biggest undertakings for any local or state government in the history of the United States. The financial crisis of this U.S. commonwealth has contributed to a high poverty rate, where 40% of Puerto Rico’s citizens are living under the poverty line and the unemployment rate has hit above 10%, along with a nearly insolvent public healthcare system.

In this article, we will take a closer look at Puerto Rico’s general obligation debt and its revenue-backed debt and the implications of the restructuring process, as well as how under the financial insolvency of a local government, bonds with higher credit ratings could be subordinate to GO bonds with lower credit ratings.

General Obligation vs. COFINA Debt

General obligation debt is a form of unsecured debt backed by the full faith and credit of the issuing government. In most cases, local governments can exercise their taxing power to increase their general fund revenues or taxes to meet their debt service requirements.

Unlike general obligation debt, special revenue–backed debt is a secured form of debt backed by special tax revenues for the local government. In Puerto Rico’s case, the island’s sales tax revenue streams were used as the special tax revenue to back its COFINA debt. The below chart shows the composition of Puerto Rico’s debt portfolio in 2006 and 2017.

Be sure to visit here to explore recent Puerto Rico muni bond trades.

The Dispute Between GO and COFINA Debt Holders in Puerto Rico

Throughout the financial restructuring of Puerto Rican debt, there has been an emergence of two primary disputes between GO and revenue-backed debt.

Many investors assume, rightfully so, that revenue-backed debt is a relatively safer investment option and consider its position to be higher than general obligation debt, due to the specific revenue streams that are typically collateralized to make payment on these bonds. However, this assumption can be severely challenged in the event of local government insolvency or restructuring efforts. This conundrum has caused quite a stir among Puerto Rico’s GO and COFINA debt holders. GO bondholders and their legal representatives have brought forward lawsuits claiming that their debt obligations must be met by the island’s government before COFINA’s are paid, irrespective of any revenue pledges, liens or secured debt. There have been many references and interpretations made towards the GO debt structures, and the island’s Constitution states that GO debt must be paid before other expenses. The legal teams in favor of GO bonds have argued that the COFINA structure is invalid and violates the island’s Constitution, because Puerto Rico cannot continue to pay its sales tax bonds while skipping GO payments, especially when GO debt structure entails claim on any “available resources” of the commonwealth, including sales tax revenues.

On the other hand, COFINA debt holders have filed their own lawsuits claiming that their debt indentures allow them to have the first claim on any revenues generated through sales tax, and that these revenues are not part of the general revenue to pay general debt obligations prior to revenue debt. In addition, they have also claimed the invalidity of GO debt, since any GO debt issued after 2011 has been over the constitutional limit and, according to the lawsuit, should be rendered invalid. COFINA holders also say that since the sales tax revenue is specifically pledged for payment of revenue-backed debt, it doesn’t constitute “available resources” and cannot be mingled into the general fund.

As if this feud wasn’t enough to keep investors occupied, there have been internal legal disputes between senior and subordinate COFINA debt holders. As in many local U.S. governments, revenue debt is typically issued depending on the timing and the capital needs of the municipality and can often be structured with senior and subordinate lien positions on the pledged revenues. As the sales tax revenues are also on a decline for the commonwealth, COFINA holders are scrambling to get clarity on their positioning to claim those sales tax revenues. In obvious terms, senior debt holders claim that their debt service obligations must be met before any junior or subordinate lien positions are paid; senior lien holders would like this to be true for both semi-annual debt payments (such as interest and principal payments) or full payment on senior holdings prior to subordinate debt in the event of bankruptcy. Subordinate debt holders disagree with these terms and would like to have a claim on the sales tax revenues equal to that of the senior debt holders.

Keep our glossary of municipal bond terms handy to familiarize yourself with different concepts commonly used by municipal investors.

Be sure to read our previous take on Puerto Rico’s default here.

COFINA-like Structuring of Chicago’s Debt

As the state of Illinois struggles with the lowest credit ratings in the United States, Chicago’s recent sales tax securitization financing structure helped the city achieve a AAA rating from the rating agencies. This process seems quite similar to Puerto Rico’s COFINA debt structuring. Under this new sales tax securitization structure, the city has been able to refinance or refund and issue new debt, generating tremendous savings with the enhanced ratings.

Be sure to check out this article to learn more about the due diligence process for evaluating municipal bonds.

The Bottom Line

The fiscal crisis in Puerto Rico, combined with the recent natural disasters, has created even bigger challenges for the commonwealth and its people. For the everyday municipal debt investor, Puerto Rico serves as a great example that highlights the intricacies of municipal debt markets and challenges the beliefs held by many investors about their investment holdings. Where COFINA holders have argued that the commonwealth’s fiscal plan undermines the revenue pledges of their instruments, GO bond holders are interpreting the law to fit their narratives.

Check out the different ways to invest in muni bonds to stay up to date with the current investment strategies.