Capital markets around the world have felt the wrath of the COVID-19 threat, and investors are asking whether a global recession is imminent.

Consider the following facts:

- The S&P fell close to 1,000 points from Feb 24 to March 23 (3,225 to 2,237), recording a 31% loss;

- The small and non-essential businesses will be hardest hit along with their employees;

- The hardest hit areas in the U.S are also seeing rising unemployment numbers; and

- The federal government’s financial stimulus package is still being debated, and its impacts – both positive and negative – are yet to be fully determined on how they might affect the economy.

For municipal debt investors, the most important question to ask right now is whether there will be municipalities facing the financial strains leading up to a potential for bankruptcies.

In this article, we will take a closer look at how the current COVID-19 situation is affecting the municipal debt markets, and municipal finances in general.

Be sure to check out our Education section to learn more about municipal bonds.

The Impacts on One of the Largest sources of Revenues for Local Governments

For local and state governments throughout the U.S, sales tax account for a significant share of the total general revenues. Let’s look at four major local governments:

| Local Government | Sales Tax Revenues ($ M) | % of General Fund Revenues |

|---|---|---|

Dallas, TX | 295 | 23% |

Seattle, WA | 281 | 18% |

San Francisco, CA | 291 | 7% |

Washington, DC | 1,537 | 18% |

In recent times, as more businesses have been ordered to shut their doors for an unspecified period of time and millions of people in multiple states have been ordered to stay home, consumer spending and sales tax revenues for all levels of government are down. This means that governments will need to understand the impacts of a substantial decline of one of their major sources of revenues.

The same applies to smaller and mid-sized cities, counties and other local agencies that are overly dependent on sales tax revenues for their operations, and their revenues sources may not be diversified enough to weather the storm of COVID-19.

Let’s take a quick look at the impacts of low sales tax revenues and what might be impacted.

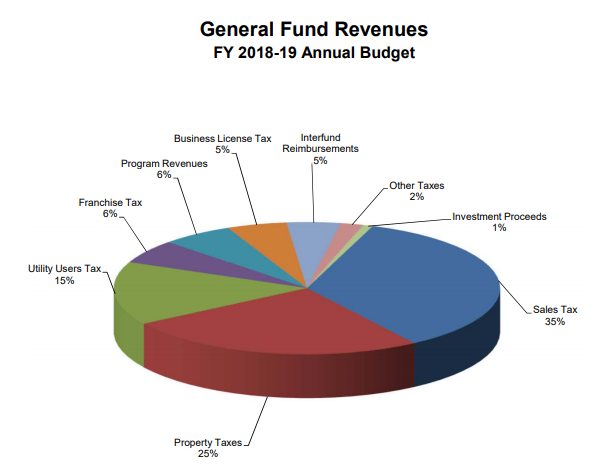

Stockton, CA’s sales tax makes up 35% (approximately $80 million) of the mid-size city’s total general fund revenues ($227.6 million), and it has gone through a municipal bankruptcy.

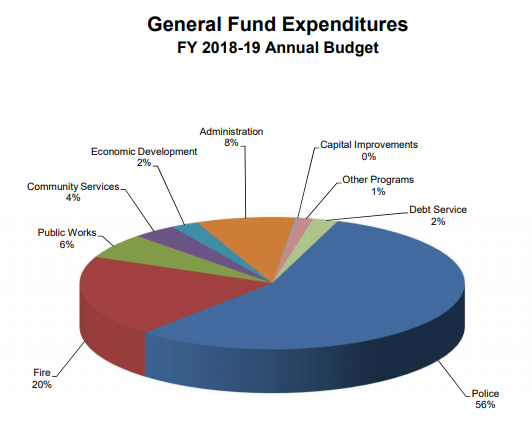

Now, when reviewing the city’s overall general fund expenditures, Stockton spends 76% ($167 M) of its general fund revenues to provide police and fire service for the city’s residents – meaning that if the city’s largest revenue source (i.e. its sales tax) declines, it might be forced to cut some of its big-ticket expenditures like police and fire budgets.

Now, depending on how long the shutdown of a large part of the U.S remains in place, this could have serious consequences for cities, counties and governmental agencies and make situations even worse for smaller agencies with less-diversified revenue sources.

Dont forget to check out our take here on understanding the comprehensive annual financial reports (CAFR) as reported by your local, state and other government entities.

Other Revenue Sources to Watch For

As investors assess the financial strength of local governments and agencies, it’s important to analyze a city’s reliance on various revenue sources and which services could be cut first in the event of not being able to fund its expenditures. In the aforementioned example of Stockton, the top three revenue sources – sales tax, property tax and utility users tax – are all likely to be severely impacted in a financial downtown, and they make up 75% of the city’s total revenue expenditure.

At the state level, Goldman Sachs has revised its unemployment forecast sharply higher due to the impact of COVID-19 and estimates a 5.5 percentage point increase in the unemployment rate to a 9% peak in impending quarters. This translates to lower personal income tax revenue for states, which is among their biggest sources of revenue.

The current COVID-19 situation can have a long-term impact on all areas of the financial markets and global economy the longer it persists and the shutdown continues.

Other Areas of Concern for Local Governmental Entities

- Near-term liquidity: Liquidity levels are likely to take a hit for all local and state governments and governmental entities. This means that agencies are likely to burn through their cash and short-term investment reserves to stay afloat, which will, ultimately, impact transportation agencies more because they heavily rely on their ridership revenues, and given the shutdown, more and more employers have asked their employees to work from home or they have simply shut down. This means extremely low ridership, and the corresponding low revenues.

- Pension obligations: It’s also critical to note that equity market fluctuations will severely impact the pension obligations of governmental agencies – pension portfolio returns are directly related to the pension obligation for which a government agency is responsible – which has created unfunded liabilities for many agencies. This is likely to worsen during the current pandemic.

- Public-Private Partnerships (PPPs): PPPs and municipal debt issued under such agreements may also be severely impacted, which could be debt issued by an airport or hospital. For instance, air travel is going to be one of the hardest-hit areas.

- Hospitality sector: The same goes for the Transient Occupancy Tax (TOT), which is applicable and charged on hotel stays and turned over to the local government body. The shutdown and travel cancellation will have a severe impact on this revenue source as well.

Click here to learn more about the municipal debt due diligence process.

The Bottom Line

As more and more states are shut down, and people are ordered to stay home, all levels of the economy will suffer. Investors must carefully review their future investments into municipal debt – and the revenues that back that debt – to understand the underlying exposure.

On a lighter note, financial markets will benefit from an economic stimulus package by the federal government. However, the current damage will definitely be felt in upcoming months. Important to remember is that there is a three-month lag between consumers spending today and the sales tax revenue receipts for local governments. This means that the current low consumer spending equals low sales tax revenue for the month of June.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.