Investors often hear the term “yield curve” and how certain forces in financial markets and political decision-making may affect the shape of the yield curve – indirectly impacting their fixed-income and equity holdings.

In recent times, the yield curve has been the main talking point for many financial gurus and their commentary on the effects of interest rate hikes by the Federal Reserve. As short-term interest rates have been on the rise, the possibility of the yield curve inversion has also taken center stage in many discussions amongst policymakers and investors. A yield curve inversion happens when the short-term rates on government debt pass the interest rates on long-term debt.

In this article, we will take a closer look at the flattening of the yield curve as the short- and long-term rates are getting closer and closer, and the potential impacts of an inversion on fixed-income financial markets.

Be sure to click here to learn more about the yield curve and the implications for municipal bond valuations.

Yield Curve and Factors That Influence It

In simple terms, the yield curve is a graph that plots yields on debt instruments from shorter (3 months) to longer maturities (30 years). The y-axis of the yield curve graph represents the interest rate an investor would expect to receive on a debt instrument, while the x-axis represents the time to maturity. Like any investment instrument, if an investor is investing his or her capital for a longer period of time, he should expect to receive a higher return than an investor deciding on a short-term investment. Therefore, short-term bonds typically offer lower coupons than longer maturities. Hence, a normal yield curve looks similar to a half-bell shape, where the curve begins in the lower corner of the two axes and the yield rises with the longer maturities.

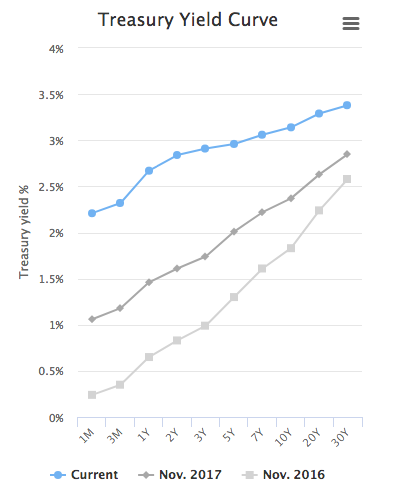

The yield curve is very dynamic in nature, which is quite reflective of the general market condition and future outlook of the financial markets. As mentioned above, the normal curve is represented when the longer maturities are yielding higher than shorter maturities; however, the curve steepens when the rates on longer maturities are rising faster than the rates on shorter maturities. Along the same lines, the curve flattens when the rates on shorter maturities are rising faster than the longer ones – which is the current environment.

So, what impacts the short and long ends of the yield curve?

The shorter interest rates are primarily influenced by the outlook of the Federal Reserve’s decisions on increasing or decreasing the short-term rates – the short-term rise or fall when the Federal Reserve is expected to raise or cut interest rates. However, the long-term rates are primarily influenced by the general outlook of federal policies, which include economic growth, inflation and investors’ attitude towards risk. For example, in an environment of relatively low inflation and slow economic growth, investors are generally risk-averse and they seek safety in the form of fixed-income instruments, which puts a downward pressure on yields. An environment of relatively higher inflation and high economic growth, which puts an upward pressure on yields.

Use Municipal Bond Screener to filter out municipal bonds based on multiple criteria including state of issue, maturity date, coupon and insured status.

Thinning Spreads Between Longer-Term and Shorter-Term Maturities

The shorter- and longer-term treasury spreads have significantly narrowed in the recent years, which has led to a relative flattening of the yield curve.

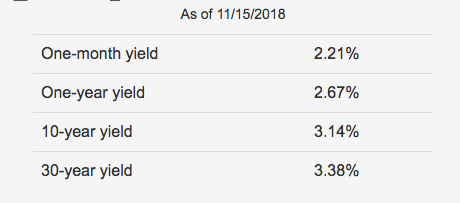

The data below shows that the one-year fixed instrument is yielding at 2.67%, where a longer maturity (30-year) is yielding at 3.38% – a spread of a mere 71 basis points. This simply means that an investor will earn an extra 0.71% yield on the added 9 years of duration.

The flattening of the yield curve is also quite evident when comparing year-over-year yields on various maturities. The curve’s shorter-term rates have been moving significantly faster than the long-term rates. The diagram below compares the yield curve of three consecutive years, where the curve’s shorter end has moved up over the years and the current yield curve is much flatter than before.

Be sure to check this article to know what higher interest rates mean for municipal bond investors.

Impacts of Potential Inversion of the Yield Curve

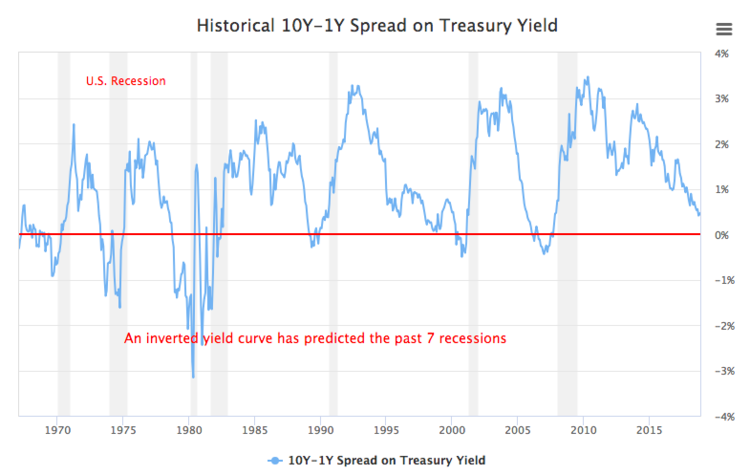

As shown in the data and comparative yield curves, the 10Y–1Y spread is significantly low, and if the spread ever goes into negative, it will mean that shorter maturities are yielding higher than longer maturities and the yield curve has inverted. An inverted yield curve is indicative of a bearish economy, which will also mean that the Federal Reserve and the financial markets have contrary views on the economy and economic growth on many levels.

Historic yield curve inversion has always been followed by an economic recession in the U.S. economy, as shown in the graph below. Yield curve inversion is avoidable if policymakers are cautious with their aggressive interest rate hikes and long-term rates begin to rise with the relative financial outlook. As discussed above, the rise in long-term rates is quite indicative of the growth prospects for the U.S. economy in the future, which means that investors will need to perceive these growth prospects in the U.S. economy. In addition, if inflation is expected to rise in the future, investors will perceive that as an added risk to their returns and flock to safety.

The Bottom Line

The yield curve and other benchmarks can be used for evaluating bond prices and yields. This information is critical for issuers during the bond pricing process and setting up baselines to establish yield levels for their new issuances and comparing the pricing of other bond offerings.

For investors, the municipal debt sector has been a safe haven, mainly due to the market and political uncertainties, along with the relative safety of municipal debt. However, given the dynamic nature of the yield curve and the possible risk of yield curve inversion, along with lower treasury spreads between 10Yy–1Y and a rising interest rate environment,the interest of investors may shift to other fixed-income instruments or even to other asset classes.

Signup for our free newsletter to get the latest news on municipal bonds.

Dont forget to visit our Education section to learn more about different investing strategies tailored for municipal bondholders or check out our Risk Management section to learn more on tackling risks.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.