If California were its own country, it would be one of the largest in population and GDP size. It’s also one of the largest issuers of municipal bonds. So, when anything potentially impacts its population, economic status, tax collection, or otherwise, muni investors take notice. And right now, they are taking notice in a big way.

The impact of the recent wildfires in several key California cities and regions is just starting to be known.

For current and would-be investors in the muni space, the question remains: what exactly will come from California bonds, and if the wildfire-insured volatility be an opportunity to bet big on the state’s reliance and its credits?

Unprecedented Damage

Fueled by hurricane-forced Santa Ana winds and severe drought conditions, two separate main wildfires and several smaller fires quickly spread across the Pacific Palisades, Malibu, Altadena, and Pasadena neighborhoods in California. The severity of the fires has been significant. At first estimate, more than 41,,000 acres have been burned, while more than 12,000 structures have been damaged or destroyed, including a variety of economic hot spots within the state.

While the fires are finally out, loss tallies for the economic and insurance burden are only beginning to be made — and the initial results aren’t good.

A preliminary estimate by weather data and forecaster AccuWeather predicts damage and economic losses to be between $135 billion and $150 billion. Putting that into perspective, the total damage from the wildfires could be as much as 4% of the annual GDP for the state of California. Insurer Aon predicts that the L.A. County fire will be the costliest wildfire in U.S. history — a view shared by Moody’s. The previous costliest wildfire U.S. was also a California fire:: 2018’s Camp Fire in Paradise, which had losses of $12.5 billion, adjusted for inflation.

And now with the last embers smoldering, many insurers have released their loss estimates. For example, Allstate reported losses of $1.1 billion, while Travelers has pegged its burden at $1.7 billion.

California’s Muni Bonds

While insurance losses from the wildfires are expected from the wildfires, bond investors have a unique position. California is one of the issuers of muni debt. It’s the single largest, with more than $675 billion worth of municipal bonds outstanding. Its sheer size and scope make California state and city bonds a staple of practically every municipal bond fund. For example, the S&P Municipal Bond Index has about 17% of its portfolio in California bonds.

So, wildfires are everyone’s problem within the municipal bond sector. And investors have started to react accordingly. Yields have begun to rise for Californian debt, with the S&P Municipal Bond California Index producing a negative 0.7% total return for the year so far. While that may not seem too bad, for the boring muni market, it’s not great.

Moreover, many individual issuers have started to realize downgrades. The Los Angeles Department of Power and Water (LADWP) — the largest muni issuer in the affected area — recently received downgrades from both Moody’s and S&P Global. LADWP-issued bonds’ yields have spiked over 100 basis points. Altadena public library bonds, which have largely traded at or above par since their issue, are now trading for about 94 cents on the dollar.

While there may be a lot of loss potential and reasons to be concerned, history and finances may be on the side of investors.

For one thing, California’s finances are still pretty good, and insurance should be able to pick up the check. Currently, California’s state government has $21 billion in its rainy-day fund and borrowable resources of around $90 billion. Los Angeles County features a general fund reserve of $5.4 billion. That’s a lot of cash helping to pay for already-issued municipal bonds.

Secondly, insurance and federal aid will go a long way to recouping the costs of the disaster. Before leaving office, President Biden approved a Major Disaster Declaration for the state, allowing California and its local governments to take advantage of Federal Emergency Management Agency (FEMA) assistance, which has historically covered about 75% of emergency costs for local governments.

At the same, the California FAIR Plan Association, which is a syndicate of insurers, provides basic fire coverage to California residents when traditional carriers are unavailable. Here again, losses for fires will be covered.

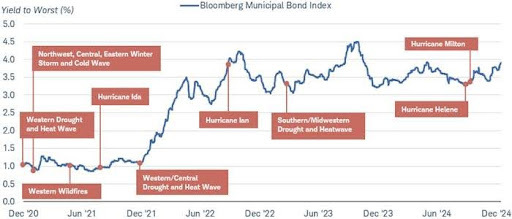

Then there is a historical context to consider. According to Moody’s, no municipal bond rated by the agency has ever defaulted due to a natural disaster. This chart highlights the reliance of muni bonds during natural disasters.

Source: Charles Schwab

Then there is wildfire precedence to consider. The previous Camp Fire destroyed the town of Paradise. Nonetheless, the bonds issued by the municipality made all their scheduled debt-service payments in the wake of the disaster and currently have recovered to a stable outlook and A rating by S&P. Federal and state funding helped keep the bonds paying their coupons and maintaining their high rating.

Strong Potential

The California wildfires were beyond tragic, and the losses of property lives, and economic growth will hit hard on a societal level. But they shouldn’t have an effect on the overall municipal bond market or California-specific bonds. While risks remain for smaller issuers within the state, the overall state’s bonds and broader municipal market should bounce back just fine over the long term.

This could make buying California munis or the broader muni market an easy decision.

California Municipal Bond ETFs

These ETFs were selected based on their ability to provide low-cost exposure to the California municipal bond market. They are sorted by their YTD total return, which ranges from 2.71% to 4.1%. They have expense ratios between 0.08% and 0.65% and assets under management between $25M and $2.8B. They are currently yielding between 2.7% and 3.75%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| PWZ | Invesco California AMT-Free Municipal Bond ETF | $829M | 4.1% | 3.23% | 0.28% | ETF | No |

| FCAL | First Trust California Municipal High income ETF | $223M | 3.8% | 2.92% | 0.65% | ETF | Yes |

| MMCA | NYLI MacKay California Muni Intermediate ETF | $25.7M | 3.1% | 3.74% | 0.37% | ETF | Yes |

| CMF | iShares California Muni Bond ETF | $2.79B | 2.8% | 2.73% | 0.08% | ETF | No |

| VTEC | Vanguard California Tax-Exempt Bond ETF | $35.2M | NA | 2.71% | 0.08% | ETF | No |

This may be a time when active management could make a difference. Active managers could potentially avoid the troubled areas of California while focusing on the best of the state. That could help drive returns and overall yield.

In the end, disaster is tough to navigate on many levels. However, municipal bonds may not be one of them. California’s finances remain strong, and history tells a story of resilience for California and other states hit hard by natural disasters. This time shouldn’t be any different.

Bottom Line

As the largest municipal bond issuer and one of the biggest states in terms of GDP, anything that affects California should be taken seriously. Wildfires are no exception. However, rather than run from the state’s munis, investors should be buying. Historically, California should be just fine.